🤖 AI Summary

Overview

This episode delves into the critical role of the Bureau of Labor Statistics (BLS) in shaping economic policy and decision-making, particularly in light of potential budget cuts. It also explores the paradox of AI-driven corporate strategies leading to layoffs, the rising price of gold as a safe-haven asset, and the implications of falling mortgage rates for the housing market.

Notable Quotes

- Errors and biases in data have become a bigger concern, and trust in the data is essential for a functioning economy.

- Abdullah Al-Barani, on the importance of reliable economic data.

- The companies riding the highest on the AI wave are also making some of the deepest cuts.

- Megan McCarty Carino, on the paradox of AI investments and layoffs.

- Inflation as measured by the CPI is critical — if it's too low, seniors can't keep up with rising costs; if it's too high, taxpayers overpay.

- Kathleen Romig, on the stakes of accurate inflation measurement.

📊 The Value of the Bureau of Labor Statistics (BLS)

- The BLS, with its $700 million budget, produces essential economic indicators like the Consumer Price Index (CPI) and monthly jobs reports.

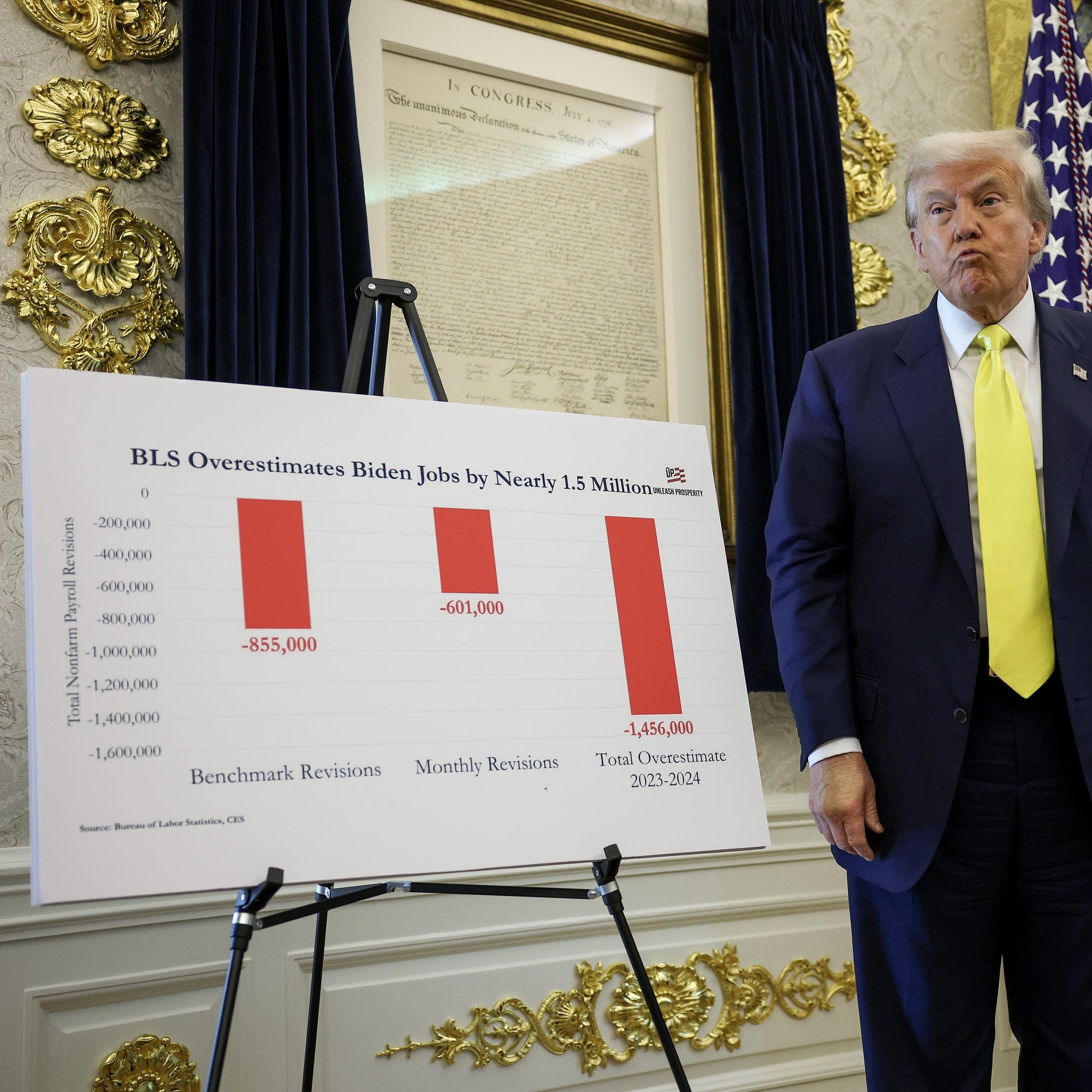

- Catherine Ann Edwards explained how payroll tax records provide the most accurate job data, but delays in accessing this data necessitate interim estimates, which can lead to revisions.

- Declining survey response rates and staff cuts have forced the BLS to rely more on imputed data, raising concerns about accuracy.

- The CPI directly impacts Social Security adjustments, inflation-indexed Treasury bonds, and tax brackets, making its precision vital.

🤖 AI Investments and Corporate Layoffs

- Companies like Oracle, Microsoft, and Meta are heavily investing in AI infrastructure, with costs skyrocketing to $20–30 billion annually, sometimes doubling.

- These investments have led to strategic layoffs in other divisions, such as health, gaming, and the metaverse, as firms prioritize AI.

- Daniel Newman highlighted the immense costs of AI, including data centers, energy, and talent, while Sarah Myers-West warned of the risks of over-investment in a single technology.

🏠 Falling Mortgage Rates and Housing Market Dynamics

- Mortgage rates have dropped to 6.3%, driven by falling Treasury yields, potentially making homeownership more accessible.

- However, Mitchell Hartman noted that layoffs and economic uncertainty are pushing more affordable homes onto the market, signaling broader economic challenges.

- Real estate broker Israel Hill observed significant price cuts on high-end homes, reflecting a cooling market.

💰 Gold as a Safe-Haven Asset

- Gold prices have surged to an all-time high of $3,700 per ounce, driven by geopolitical tensions, inflation fears, and central banks seeking alternatives to U.S. dollar reserves.

- Chantel Skiven explained that sanctions on Russia highlighted gold's resilience as a store of value, while Konstantinos Krisikos emphasized its appeal during periods of global uncertainty.

- Falling bond yields have further boosted gold's attractiveness relative to other assets.

📚 Economic Literacy and Trust in Data

- Abdullah Al-Barani stressed the importance of teaching economic literacy to help individuals navigate complex systems and make informed decisions.

- He warned that declining trust in economic data could lead to suboptimal decision-making and increased economic volatility.

- The politicization of institutions like the BLS and proposed budget cuts threaten the integrity of critical economic data, which underpins policymaking and public trust.

AI-generated content may not be accurate or complete and should not be relied upon as a sole source of truth.

📋 Episode Description

Budget cuts may be in the Bureau of Labor Statistics' future. But the data collected by the BLS is critical for federal decision making. In this episode, we calculate if the $700 million investment is worthwhile. Plus: Firms that spend the most on AI slash tons of jobs, economic uncertainty drives up the price of gold, and mortgage rates fall — which is good for buyers but a bad sign for the overall economy.

Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.

Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.