🤖 AI Summary

Overview

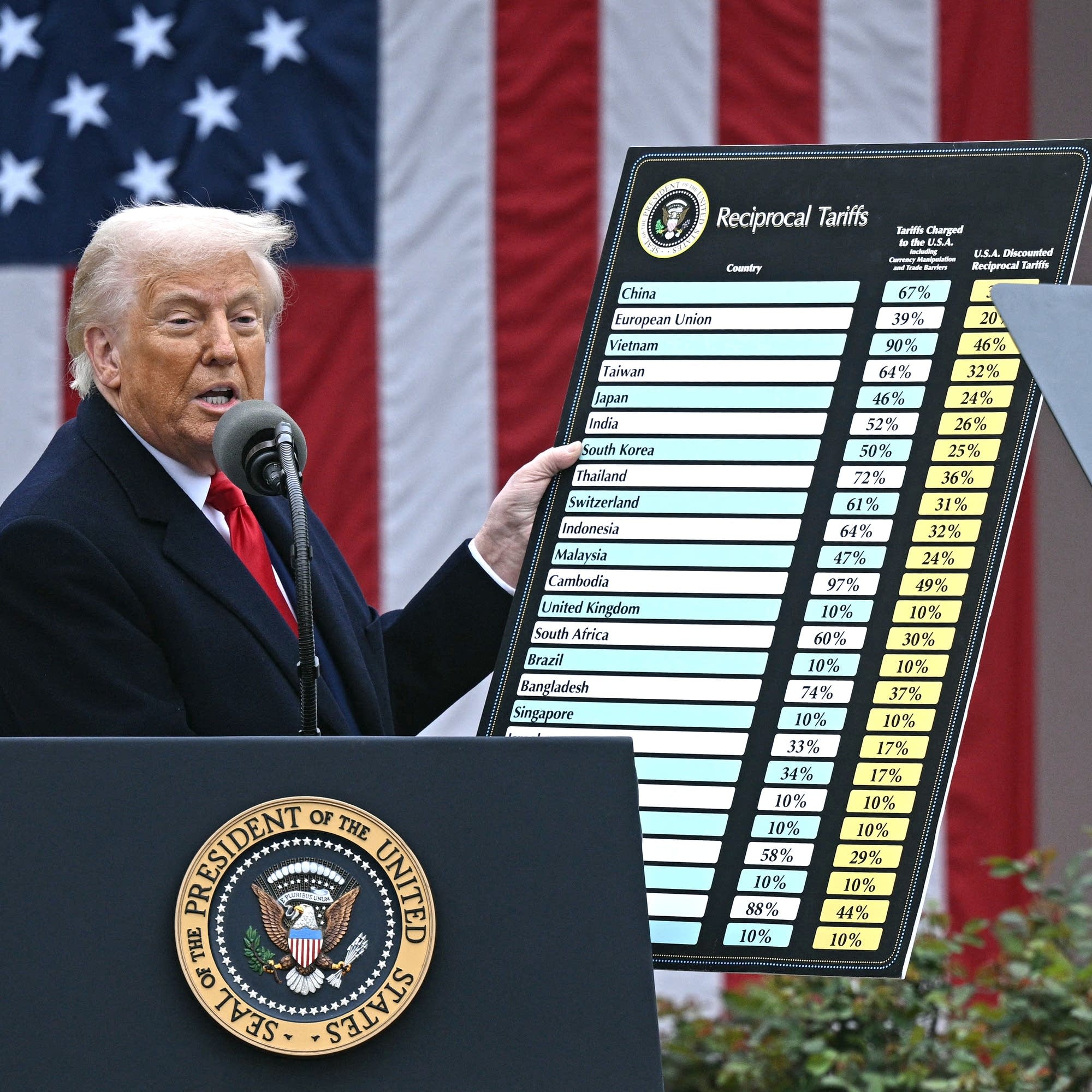

This episode delves into the Supreme Court case examining the legality of President Trump's tariffs under the International Emergency Economic Powers Act (IEPA). It explores the economic and legal implications of the tariffs, their impact on small businesses, and potential alternatives if the tariffs are deemed unlawful.

Notable Quotes

- We need to work with China. We need to work with the world. Hopefully, we're not going to just be an isolationist economy.

- Todd Adams, on the necessity of global trade relationships.

- If the president ends up having a freestanding power to impose taxes, he'll be able to regulate through that mechanism.

- Blake Emerson, on the potential risks of presidential overreach.

- We lost 80% of our vineyards and all of our buildings in the glass fire of 2020... but we’ve used this time to replant and regrow our business.

- Katie Lazar, on resilience amidst challenges.

🛠️ The Impact of Tariffs on Small Businesses

- Todd Adams of Sanitube highlighted how tariffs have increased costs for imported stainless steel tubing, forcing price hikes that could eventually affect consumer goods.

- Katie Lazar of Cane Vineyard shared that tariffs have completely wiped out their international wine sales, compounding challenges from domestic neo-prohibitionist movements.

- Both business owners emphasized the need to adapt, with Todd diversifying suppliers and Katie focusing on rebuilding relationships and domestic sales.

⚖️ Legal Questions Surrounding IEPA and Tariffs

- Blake Emerson, a law professor, explained that the Supreme Court will decide if the IEPA grants the president authority to impose tariffs, a power traditionally reserved for Congress.

- The case hinges on the major questions doctrine,

which requires explicit statutory authority for policies of vast economic significance.

- The court's decision could redefine the balance of power between the presidency and Congress, particularly concerning economic regulation.

💸 The $90 Billion Refund Dilemma

- If the tariffs are ruled illegal, the government may need to refund $90 billion in tariff revenue.

- Rachel Brewster from Duke Law School noted that small businesses might struggle with the bureaucratic process of filing for refunds.

- Financing these refunds could strain the Treasury, potentially requiring the issuance of short-term bonds, with uncertain demand from investors.

📜 Alternative Tariff Strategies

- The episode explored other tariff mechanisms available to the president, such as anti-dumping duties, national security tariffs, and rarely used provisions from older trade laws.

- These options often require investigations or congressional approval, making them less immediate but still viable tools for trade policy.

- Sabri Ben-Achour highlighted examples like tariffs on Chinese pea protein, which were imposed to counteract unfair trade practices.

AI-generated content may not be accurate or complete and should not be relied upon as a sole source of truth.

📋 Episode Description

The U.S. Supreme Court will hear arguments on Wednesday for and against the legality of President Trump’s signature economic policy: tariffs. In this episode, a lawyer walks us through what’s at stake and how the major questions doctrine may come into play. We also consider whether it’s possible to repay the $90 billion accumulated in tariff revenue should SCOTUS rule against the president, and scrutinize potential ‘plan B’ tariff policies.

Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.

Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.