Netflix vs. Paramount: Inside the Epic Battle Over Warner Brothers

🤖 AI Summary

Overview

This episode explores the high-stakes battle between Netflix and Paramount over acquiring Warner Brothers Discovery, a deal that could reshape Hollywood. The discussion delves into the implications for streaming, theatrical releases, the creative community, and the broader entertainment industry.

Notable Quotes

- Whoever wins, we lose.

– Kyle Buchanan, on the potential downsides of consolidation in the entertainment industry.

- Netflix competes with sleep.

– Nicole Sperling, highlighting Netflix's relentless drive to dominate consumer attention.

- The theatrical market is like gambling with ridiculous odds.

– Nicole Sperling, on the inefficiencies of the traditional movie theater business model.

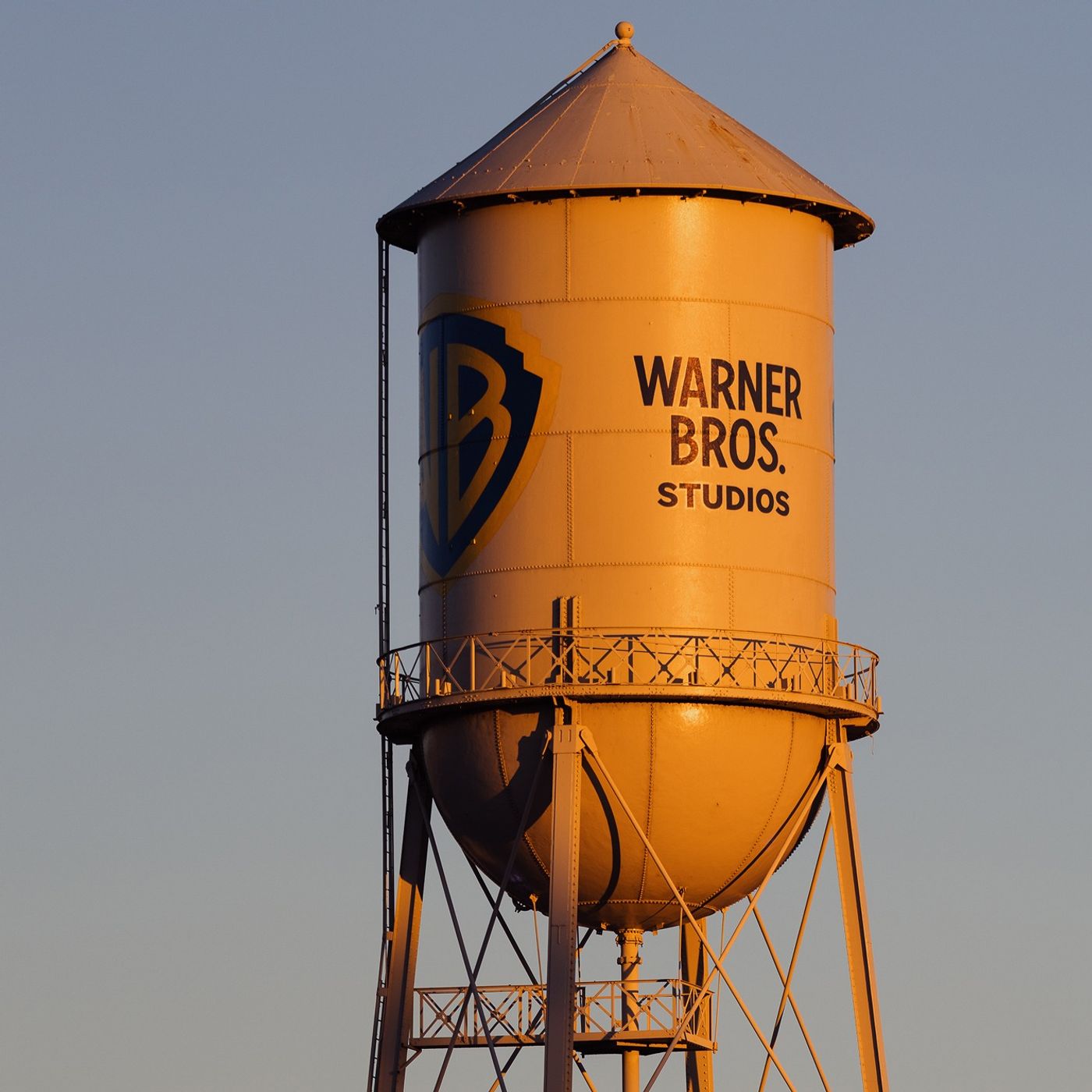

🎥 The Legacy of Warner Brothers

- Warner Brothers, a 100-year-old Hollywood institution, is described as a crown jewel

with a storied history, from Casablanca to Batman.

- The studio's current owner, Warner Brothers Discovery, has struggled post-merger, with cable channels like CNN underperforming.

- HBO, a key asset, is considered the gold standard of television, making Warner Brothers highly attractive to both Netflix and Paramount.

📈 Netflix's Bid and Its Implications

- Netflix's $83 billion offer focuses on acquiring Warner Brothers' streaming and studio businesses, leveraging its tech and optimization capabilities.

- The deal would expand Netflix's subscriber base and allow it to enter the theatrical and TV studio markets, areas it has historically avoided.

- Concerns arise that Netflix's ownership could accelerate the decline of movie theaters, as Netflix prioritizes streaming over theatrical releases.

- Critics fear Netflix's history of dismissing the theatrical experience could lead to fewer films in theaters and a diminished cultural conversation around movies.

💥 Paramount's Hostile Takeover Attempt

- Paramount, under David Ellison, launched a hostile bid for Warner Brothers, offering $30 per share in cash to shareholders.

- Paramount argues its deal offers cash and certainty,

contrasting Netflix's stock-based offer.

- A Paramount acquisition could preserve the traditional theatrical model, with plans to release up to 30 movies annually.

- However, concerns include potential political influence over creative decisions and significant layoffs due to redundancies.

⚖️ Antitrust and Market Competition

- Netflix defends its bid by arguing that it competes not just with other streamers but with platforms like YouTube and TikTok, claiming it holds only 9% of total TV viewing.

- Paramount counters that the deal is monopolistic and would harm competition in the entertainment industry.

- Both companies frame their arguments around the evolving media landscape, with Paramount emphasizing the need to compete with Big Tech.

🎬 The Future of Movies and Streaming

- Consolidation raises fears about the future of movies as a medium, with streamers favoring long-form series over standalone films.

- Netflix's focus on volume over quality could dilute Warner Brothers' legacy of prestige content, such as HBO's Game of Thrones.

- Paramount's traditional approach may better support theaters, but both scenarios involve significant trade-offs for the creative community and consumers.

AI-generated content may not be accurate or complete and should not be relied upon as a sole source of truth.

📋 Episode Description

Netflix announced plans on Friday to acquire Warner Bros. Discovery’s studio and streaming business, in a deal that would send shock waves through Hollywood.

On Monday, Paramount made a hostile bid for the studio, arguing that the Netflix deal would be “anti-competitive.”

The Times journalists Nicole Sperling, Kyle Buchanan and Lauren Hirsch discuss what it all means for the future of TV and film.

Guest:

- Nicole Sperling, a New York Times reporter in Los Angeles who covers Hollywood and the streaming revolution.

- Kyle Buchanan, a pop culture reporter and the awards-season columnist for The New York Times.

- Lauren Hirsch, a New York Times reporter who covers the biggest stories on Wall Street, including mergers and acquisitions.

Background reading:

- Netflix planned to buy Warner Bros. Discovery in $83 billion deal to create a streaming giant.

- Paramount made a hostile bid for Warner Bros. Discovery.

Photo: Aleksey Kondratyev for The New York Times

For more information on today’s episode, visit nytimes.com/thedaily. Transcripts of each episode will be made available by the next workday.

Subscribe today at nytimes.com/podcasts or on Apple Podcasts and Spotify. You can also subscribe via your favorite podcast app here https://www.nytimes.com/activate-access/audio?source=podcatcher. For more podcasts and narrated articles, download The New York Times app at nytimes.com/app.